Posted by

Account Factoring: What is it?

Without working capital, a business will fail. It’s an unfortunate truth. Another unfortunate truth is that there will, at some point in a business owner’s life, be downtime. There may even be a point when the money exists but hasn’t arrived yet, as with any client who demands long credit terms. What should a business owner do in the face of a financial crisis?

Without working capital, a business will fail. It’s an unfortunate truth. Another unfortunate truth is that there will, at some point in a business owner’s life, be downtime. There may even be a point when the money exists but hasn’t arrived yet, as with any client who demands long credit terms. What should a business owner do in the face of a financial crisis?

There are plenty of reasons to want accessible cash flow during a financial crisis or even during random downtimes. Time that is spent worrying about payments could have been spent planning, marketing, and even just building a business in general. While a loan from a bank can be ideal for some, others are working with a short time frame and even shorter money. It’s a situation that can lead to a series of brick walls. Capital tends to get stuck in limbo when dealing with clients in certain industries or clients that have been wronged in the past. There aren’t many ways to generate a quick solution, even when you’re a successful business.

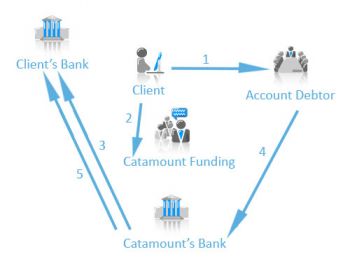

One way for businesses to get this priceless time back is by selling their accounts receivable to another company, which is called Account Receivables Factoring. This practice takes care of the long wait and the subpar capital without arduous processes for approval. A percentage of the account is advanced to the business owner in cash, giving them the capital they need to grow, get by, and put attention back where it belongs.

The amount and timeline of factoring are completely up the business owner once a factoring line is established. There is no obligation on the owner to sell every account, or even specific ones. The point of focus is to free up precious working capital that has been trapped in accounts receivable. The process itself is easy and transparent, giving many business owners both confidence and control over their situation. The credit of the business owner is not an issue. Your customers are the ones who count, so having solid and sound customers is necessary.

Some interesting notes about account factoring:

- The owner can still collect accounts

- While many factoring companies refuse to factor contractors, Catamount Funding does.

- A variety of industries utilize account factoring

- Owners are still able to participate in collecting on their sold accounts once the due date arrives, giving clients a sense of ease

Different situations will provide different solutions, and it’s up to you to decide what’s right for your business. Account Factoring is a viable option when it comes to freeing up working capital in the nick of time. It’s a quick and easy process that gives you the breathing room needed to truly focus and excel.

Catamount has always been there for us and has been very instrumental in helping us succeed.

Catamount has always been there for us and has been very instrumental in helping us succeed.

Without Catamount we would not be where we are today...period. They have been a tremendous help and are very supportive!

Without Catamount we would not be where we are today...period. They have been a tremendous help and are very supportive!

When we needed help Catamount stood up to the plate for us. Their service is outstanding...great people to work with!

When we needed help Catamount stood up to the plate for us. Their service is outstanding...great people to work with!