Posted by

I just started a new business, can I still factor?

Even with a running start, it can be hard to keep a new small business in the race. In the beginning, finding the capital to keep things going and avoid lulls takes serious effort. While other businesses shut down due to financial hardships (most in the first five years) some turn their sights to factoring to provide assistance with cash flow. When it comes to providing working capital and giving a new small business a boost, factoring works wonders. And even if you just started a new business, factoring may still be a solution.

Even with a running start, it can be hard to keep a new small business in the race. In the beginning, finding the capital to keep things going and avoid lulls takes serious effort. While other businesses shut down due to financial hardships (most in the first five years) some turn their sights to factoring to provide assistance with cash flow. When it comes to providing working capital and giving a new small business a boost, factoring works wonders. And even if you just started a new business, factoring may still be a solution.

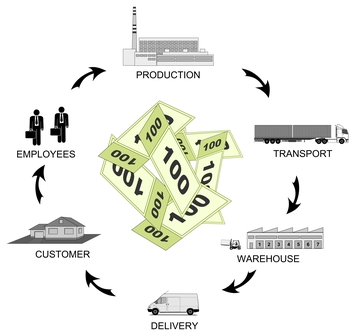

Whether the issue is with shaky capital, irregular payouts, or just a need for increased cash flow, factoring can help by:

Giving Businesses a Chance

New businesses are not usually boggled down by a lack of credit. This doesn’t mean that the business doesn’t have steady paying customers. Factoring pays attention to a small business’s paying clients and not the business itself. This makes the process suitable in the face of credit challenges. As long as the clients in question are trustworthy and creditworthy, a factoring transaction can be completed in mere days.

Keeping Things Steady

As a new business, every penny counts. Net 30 and Net 60 invoices leave a large gap in finances and can add up to a number of problems. Factoring provides a steady cash flow that can handle gaps caused by invoices that are not due on receipt.

In this regard, factoring can also cover gaps in payments caused by a new small business experiencing a rough spot from the purchase of stock and supplies. Even with a large amount of startup capital a business can become wedged in a financial dry spot. When it’s too soon to have a steady back up of cash, factoring offers an alternative.

Building Growth

A huge part of getting a new small business going is growth. Growth takes steady capital, which can be hard to come by for a new small business. Bank loans can be a tedious process, and so factoring can offer alternatives to the traditional money route.

Hard work goes into the first year of a business. There is stock to purchase, workers to pay, rent and bills (if the client works from a storefront) and more than a few expenses to take care of along the way. Growth comes through both practical spending and keeping all obligations covered with steady cash flow.

Slow Paying Customers

Slow-paying customers can be the death of a small business, new or old. Instead of waiting through the most important financial times for customers to pay an invoice, factoring affords a great sigh of relief.

The biggest plus factoring has for a brand new small business is peace of mind. With all the stress and unpredictability of starting and maintaining a business, sometimes it is nice to be able to cross one worry off your list. After all, there are a million others to choose from on any given day.

Catamount has always been there for us and has been very instrumental in helping us succeed.

Catamount has always been there for us and has been very instrumental in helping us succeed.

Without Catamount we would not be where we are today...period. They have been a tremendous help and are very supportive!

Without Catamount we would not be where we are today...period. They have been a tremendous help and are very supportive!

When we needed help Catamount stood up to the plate for us. Their service is outstanding...great people to work with!

When we needed help Catamount stood up to the plate for us. Their service is outstanding...great people to work with!